Klarna’s IPO Lands Above Range

Swedish buy now, pay later giant Klarna (KLAR) priced its long-anticipated IPO at $40 per share, above its original $35–$37 guidance. The stronger pricing reflects solid demand, pushing Klarna’s valuation to roughly $15.1 billion.

The company raised $1.37 billion in the offering, setting the stage for its first day of trading on the New York Stock Exchange.

A Comeback Story in Valuation

Klarna’s market cap has seen dramatic swings:

- $45.6B peak in 2021, driven by SoftBank’s investment.

- $6.7B trough in 2022, during a brutal reset for fintechs.

- Now rebounding with a $15B public valuation, more than doubling its recent lows.

This is Klarna’s second attempt at going public this year. The fintech previously delayed its IPO in April after President Trump’s “Liberation Day” tariff announcement rattled markets and IPO activity slowed.

Busy Week for IPOs

Klarna’s debut is the headline in what’s shaping up to be a packed week for Wall Street listings:

- Gemini Space Station, the crypto exchange run by Cameron and Tyler Winklevoss.

- Figure Technologies, a stablecoin issuer.

- Legence, an engineering firm backed by Blackstone (BX).

These follow recent 2025 successes, including Figma (FIG), Circle Internet Group (CRCL), and Bullish (BLSH). According to Renaissance Capital, 144 companies worth more than $50 million have gone public this year, a 53% increase over 2024, with tech IPOs raising over $12 billion.

BNPL Model Under Spotlight

Klarna, led by CEO Sebastian Siemiatkowski, is best known for its buy now, pay later (BNPL) platform:

- 111 million active users.

- 790,000 merchant partners.

- Customers can split everyday purchases into installments at checkout.

Critics argue BNPL models like Klarna, Affirm (AFRM), and Afterpay encourage overspending and expose lenders to credit risk. However, Klarna reported that 99% of its loans in 2024 were repaid on time, far outperforming the 3.05% delinquency rate on U.S. credit cards.

WSA Take

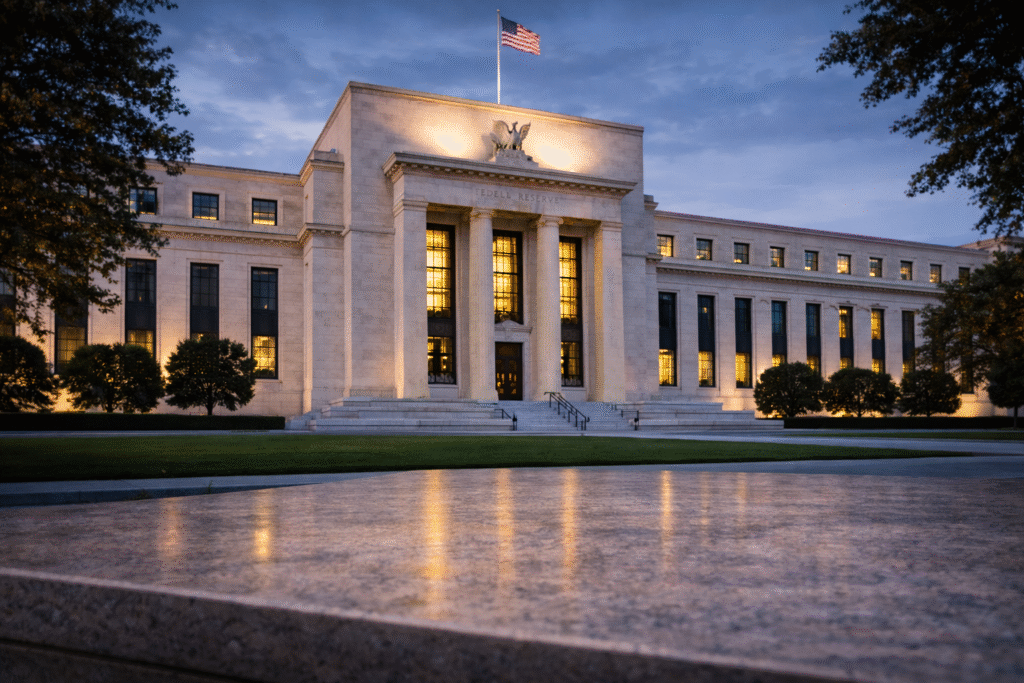

Klarna’s IPO is both a comeback and a reality check. The fintech is no longer chasing its frothy $45B SoftBank valuation, but its $15B market cap shows that BNPL demand hasn’t disappeared — it’s simply being repriced in a tougher interest rate environment.

For investors, Klarna’s debut signals two things: Wall Street’s appetite for fintech is alive, and IPO momentum is returning after a sluggish stretch. Whether BNPL can mature into a sustainable credit model, however, remains an open question.

Disclaimer

Wall Street Access does not work with or receive compensation from any public companies mentioned. Content is for educational and entertainment purposes only.