What Happened

U.S. electricity consumption is on track to climb to fresh record highs in 2026 and 2027 after setting a second straight record in 2025, based on the latest outlook from the U.S. Energy Information Administration (EIA).

The agency projects total power demand rises from a record 4,195 billion kilowatt-hours (kWh) in 2025 to 4,268 billion kWh in 2026, then to 4,372 billion kWh in 2027. The picture is straightforward: the U.S. grid is being asked to do more, and the trend looks durable.

- 2025 demand: 4,195 billion kWh (record)

- 2026 demand: 4,268 billion kWh (projected)

- 2027 demand: 4,372 billion kWh (projected)

Why Demand Is Rising

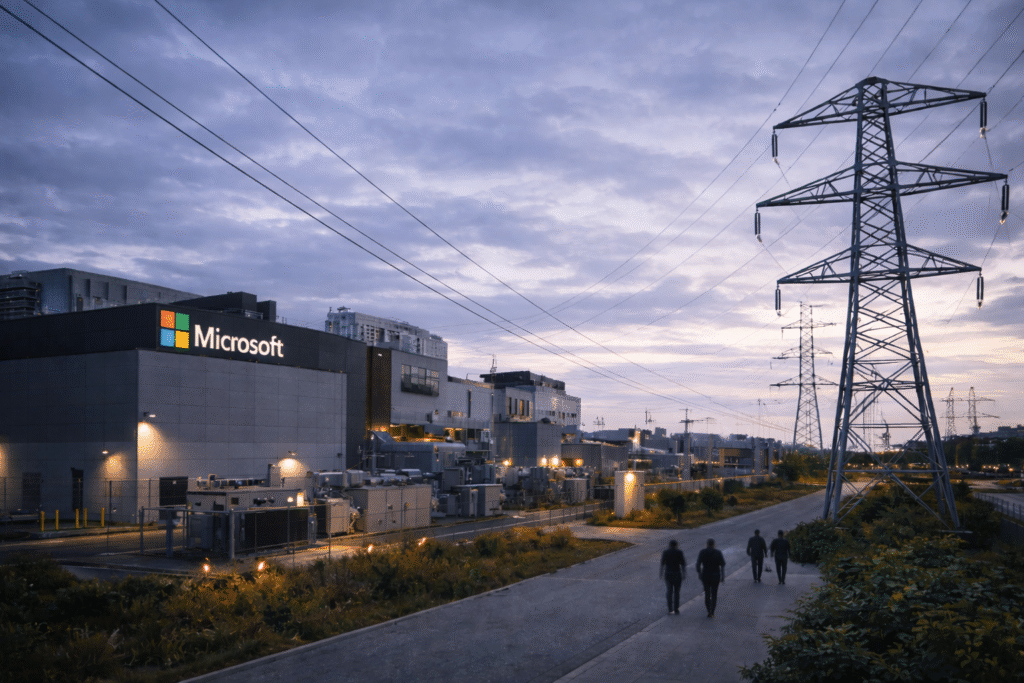

The EIA ties the demand upswing partly to growing electricity use from data centers, including facilities dedicated to artificial intelligence and cryptocurrency. At the same time, households and businesses are using more electricity and less fossil fuel for heating and transportation—another nudge higher for baseline power consumption.

For markets, this matters because sustained load growth can influence everything from utility capital spending and grid equipment demand to the mix of fuels used for generation.

- Rising AI and crypto data center electricity needs

- More electricity use in homes and businesses

- Shifting away from fossil fuels for some heat and transportation needs

Where The Load Growth Shows Up

The EIA expects power sales in 2026 to increase across major customer classes, with residential and commercial demand both moving above prior highs.

Here is the EIA’s projected breakdown for 2026 electricity sales:

- Residential: 1,541 billion kWh

- Commercial: 1,520 billion kWh

- Industrial: 1,063 billion kWh

Those forecasts compare with prior all-time highs of 1,517 billion kWh for residential customers in 2025, 1,486 billion kWh for commercial customers in 2025, and 1,064 billion kWh for industrial customers in 2000.

Generation Mix: Gas Steady, Renewables Rising

Even with demand rising, the EIA expects the generation mix to shift only gradually in the near term.

Natural gas remains the largest slice of U.S. power generation in the forecast, holding at about 40% in 2025 and 2026 before slipping to 39% in 2027. Coal continues to trend down, while renewables edge up and nuclear stays flat.

- Natural gas: ~40% in 2025-2026; 39% in 2027

- Coal: 17% (2025), 16% (2026), 15% (2027)

- Renewables: ~24% (2025), 25% (2026), 27% (2027)

- Nuclear: 18% in 2025-2027

Natural Gas Demand: Power Burn Stays Key

On the natural gas side, the EIA projects 2026 gas sales hold at 13.1 billion cubic feet per day (bcfd) for residential consumers, ease to 9.7 bcfd for commercial customers, decrease to 23.3 bcfd for industrial customers, and rise to 36.2 bcfd for power generation.

Those compare with all-time highs of 14.3 bcfd in 1996 for residential consumers, 9.8 bcfd in 2025 for commercial customers, 23.8 bcfd in 1973 for industrial customers, and 36.8 bcfd in 2024 for power generation.

What Investors Will Watch Next

The key watch item is whether the projected load growth translates into faster timelines for grid buildouts, including generation additions and transmission upgrades. For U.S. investors, the other swing factor is how quickly renewables growth and steady nuclear output can meet incremental demand without keeping gas generation pinned near current shares.

WSA Take

The EIA’s outlook reinforces a market backdrop of steady, multi-year growth in U.S. electricity demand, with data centers and broader electrification doing much of the work. The generation mix shift looks incremental rather than abrupt: natural gas remains central, while renewables take a gradually larger share and coal continues to fade. If these demand projections hold, grid reliability and capacity additions become more important inputs for utilities, equipment providers, and fuel markets. The near-term story is less about a single fuel “winning” and more about the system adding supply fast enough to keep up.

Explore More Stories in Commodities

Disclaimer

WallStAccess is a financial media platform providing market commentary and analysis for informational and educational purposes only. This content does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. Readers should conduct their own research or consult a licensed financial professional before making investment decisions.