xAI Rockets to $200B

Elon Musk’s artificial intelligence startup xAI has raised $10 billion in fresh funding, giving the company a post-money valuation of $200 billion, according to reporting from CNBC’s David Faber.

The raise marks a sharp leap from just weeks ago, when Musk tapped investors for another $10 billion in debt and equity at a roughly $150B valuation. The acceleration highlights investor appetite for firms building foundational AI models — the kind that power chatbots, enterprise tools, and next-generation applications.

The AI Valuation Surge

Musk’s xAI joins a fast-expanding list of AI unicorns commanding sky-high valuations:

- OpenAI: Valued at $500B in its latest secondary share sale.

- Anthropic: Recently raised $13B at a $183B valuation.

- xAI: Now sits at $200B, leapfrogging Anthropic into second place.

The pace reflects the AI arms race among tech giants and startups alike, as investors pour billions into companies racing to dominate foundational models.

Catching Up to Rivals

Despite the valuation, xAI’s Grok chatbot is often considered less capable than rivals like OpenAI’s GPT and Anthropic’s Claude. Its user base and performance benchmarks have lagged, but the company benefits from Musk’s platform leverage via X (formerly Twitter), where Grok is integrated.

The challenge: Musk will need to translate xAI’s hype into actual market leadership. Analysts argue that while valuations capture investor enthusiasm, model quality, adoption, and enterprise contracts will separate winners from the hype cycle.

Where the Money’s Going

Musk has been vocal about the capital intensity of building cutting-edge AI. Earlier this year, he said he wanted to buy 1 million AI chips to fuel model development.

The new $10B round is expected to support:

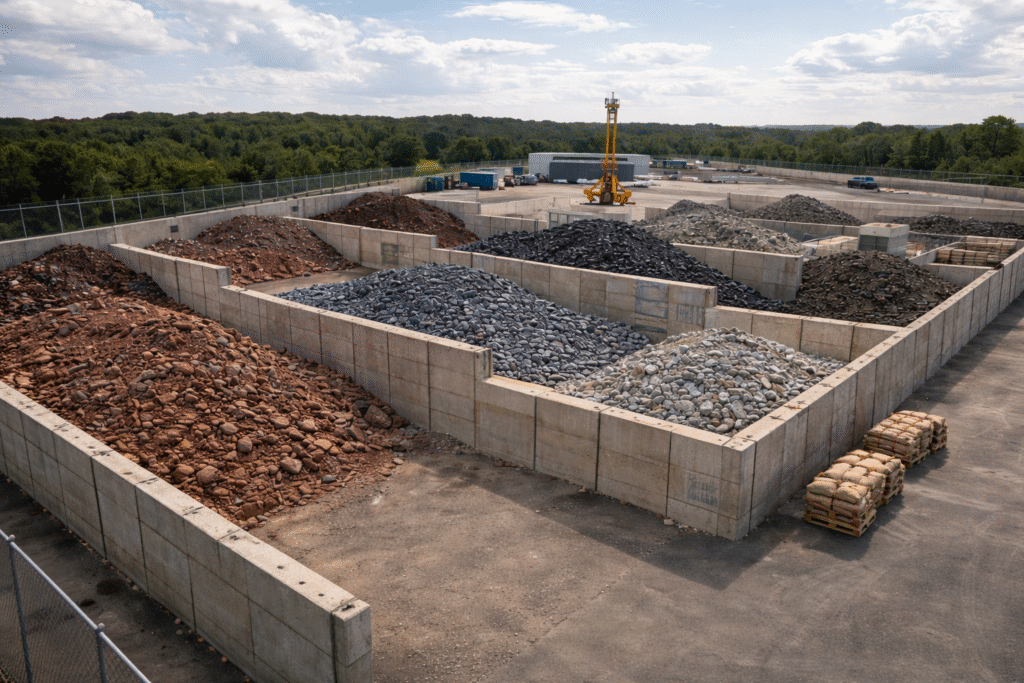

- Massive GPU infrastructure: Data centers powered by Nvidia and AMD chips, critical for training advanced models.

- Talent wars: Top AI researchers and engineers command compensation packages in the millions.

- Platform integration: Expanding Grok across Musk’s companies, including Tesla, X, and possibly even SpaceX.

Investor Implications

The scale of funding suggests Musk is betting that AI will become as transformative as EVs or space exploration. But it also underscores the capital risk: foundational AI development is hugely expensive with no guarantee of dominance.

For investors, the comparison to peers is telling: xAI now trades in the same valuation league as Anthropic, though it trails in market adoption. The upside case is that Musk leverages his unique ecosystem — Tesla data, X’s user base, and SpaceX’s reach — to give xAI differentiated scale.

WSA Take

Elon Musk has never been afraid of outsized bets, and xAI’s new raise is another moonshot. A $200B valuation for a company whose product still lags its rivals shows just how much Musk’s brand power and investor belief in AI can move markets.

The real test will be execution. Building data centers and stockpiling GPUs is a start, but turning Grok into a true rival to GPT or Claude will determine if xAI is the next OpenAI — or just another hyped-up Musk project.

If you missed our coverage of Google’s Gemini expansion in Chrome, it shows how Big Tech is embedding AI deeper into everyday products. For more insights on where AI and tech money is moving, visit the Wall Street Access homepage.

Disclaimer

Wall Street Access does not work with or receive compensation from any public companies mentioned. Content is for educational and entertainment purposes only.