OpenAI is in early discussions with Amazon about a potential investment that could exceed $10 billion, according to people familiar with the matter. The talks are ongoing, details remain fluid, and no final amount has been set, CNBC confirmed.

The potential agreement would also include OpenAI’s use of Amazon’s in-house AI chips, a strategic move as demand for compute continues to outstrip global supply.

The Information first reported the discussions.

Why This Matters Now

The talks come shortly after OpenAI completed a major restructuring in October, a shift that significantly reshaped its relationship with Microsoft and opened the door to broader partnerships across the AI ecosystem.

Microsoft has invested more than $13 billion in OpenAI since 2019, but under the revised structure:

- Microsoft no longer has right of first refusal on OpenAI’s compute needs

- OpenAI can now partner directly with third-party cloud and hardware providers

- The company has greater flexibility to raise capital independently

That change has accelerated OpenAI’s push to diversify its infrastructure stack.

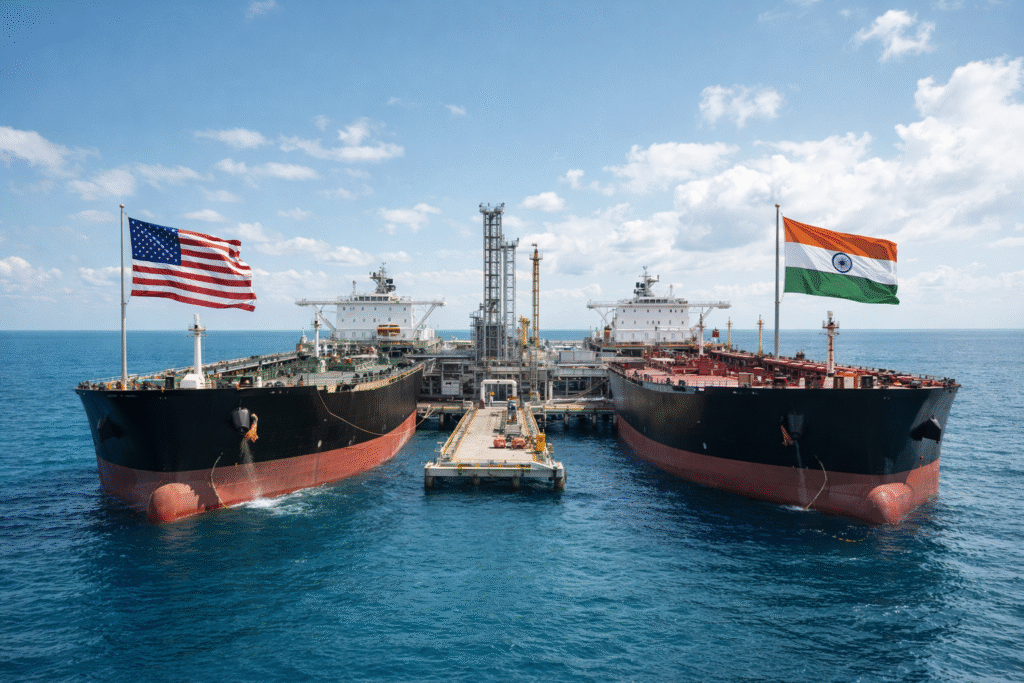

Amazon’s Strategic Angle

Amazon has already committed heavily to AI — but primarily through Anthropic, a direct OpenAI competitor.

To date:

- Amazon has invested at least $8 billion into Anthropic

- Microsoft recently announced up to $5 billion in Anthropic investment

- Nvidia has committed up to $10 billion to the startup

A direct investment in OpenAI would signal Amazon’s desire to broaden its exposure across leading foundation-model developers — not just back a single horse.

Just as important is the hardware component.

Amazon Web Services has been developing its own AI chips since around 2015, including:

- Inferentia chips (introduced in 2018)

- Trainium, its flagship training chip, with a new generation announced earlier this month

Securing OpenAI as a customer would be a major validation of AWS’s chip strategy as cloud providers try to reduce dependence on Nvidia.

OpenAI’s Infrastructure Spending Is Exploding

OpenAI’s capital needs have grown at historic speed.

In recent months, the company has made more than $1.4 trillion in infrastructure commitments, including long-term agreements with:

- Nvidia

- Advanced Micro Devices

- Broadcom

Last month, OpenAI also signed its first major AWS contract, committing to $38 billion in cloud capacity — a clear signal it is actively diversifying beyond Microsoft Azure.

In parallel, OpenAI finalized a $6.6 billion secondary share sale in October, valuing the company at roughly $500 billion and allowing employees and early investors to sell stock.

WSA Take

The potential Amazon–OpenAI deal highlights how AI is no longer just a software race — it’s a capital-intensive infrastructure war. OpenAI is rapidly diversifying its compute stack to support model growth, while cloud giants are fighting to lock in the next generation of AI demand. If Amazon secures a deep partnership here, it strengthens AWS’s position not just as a cloud provider, but as a core supplier in the AI economy’s backbone.

Read our recent coverage on Tesla Betting Big on German Battery Production.

Explore more market insights on the WallStreetAccess homepage.

Disclaimer

WallStAccess does not work with or receive compensation from any companies mentioned. This content is for informational and educational purposes only and should not be considered financial advice. Always conduct independent research before investing.