Stocks Edge Higher Despite Shutdown Jitters

U.S. stocks mostly climbed Monday as investors weighed the rising odds of a government shutdown that could disrupt the release of critical economic data.

- S&P 500 (GSPC): +0.2%

- Nasdaq Composite (IXIC): +0.5%

- Dow Jones Industrial Average (DJI): flat

The Department of Labor confirmed that the Bureau of Labor Statistics (BLS) will suspend operations in the event of a shutdown, halting the release of the monthly jobs report and key inflation updates.

With shutdown odds pegged at over 80% by Polymarket, attention is fixed on a Monday meeting between President Trump and congressional leaders.

Why the Jobs Report Matters

The September jobs report was expected to show:

- 43,000 nonfarm payroll gains

- Unemployment steady at 4.3%

Last week, stronger-than-expected GDP growth (3.8%) and a dip in jobless claims cast doubt on aggressive Fed rate cuts. If the jobs report is delayed, markets will be left flying blind on one of the Fed’s most critical inputs.

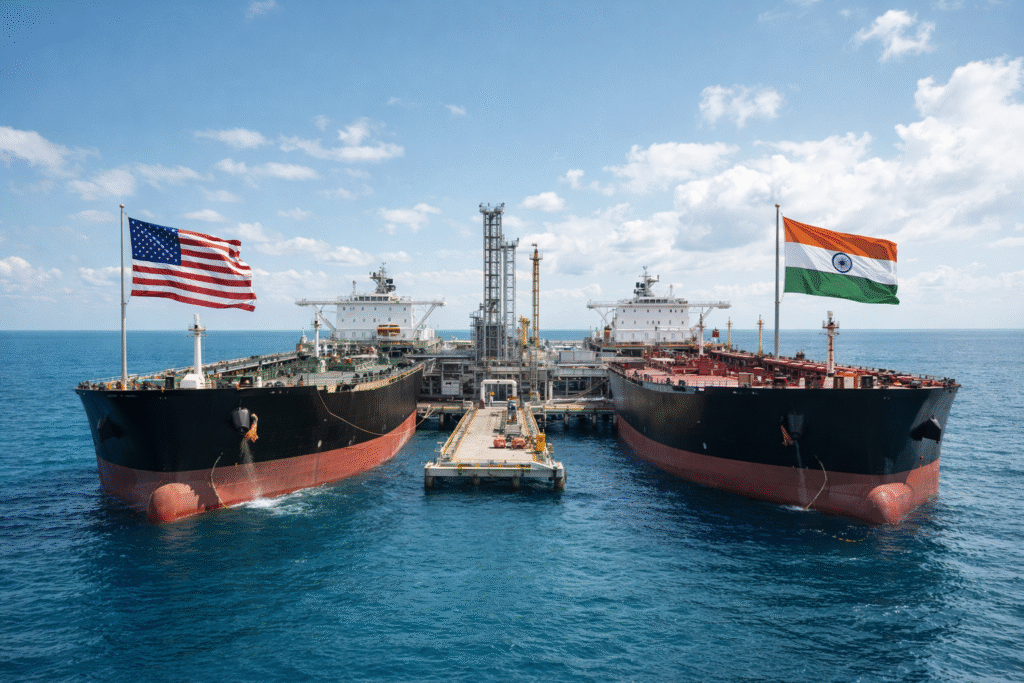

Policy & Trade Wildcards

Markets are also digesting fresh political risks:

- President Trump added to October 1 tariffs, proposing new duties on movies and furniture.

- The AI-driven stock rally showed signs of fatigue last week, adding to volatility.

Still, equities are set to close September and Q3 in positive territory:

- S&P 500: +2.8% month-to-date

- Dow: +1.5%

- Nasdaq: +2.9%

Commodities Surge: Gold & Silver

Beyond equities, commodities continue to roar:

- Gold (GC=F): +45% year-to-date

- Silver (SI=F): +60% YTD, its sixth straight weekly gain

Silver’s run has drawn comparisons to a short squeeze, with traders forced to cover bearish bets. Prices are now approaching 1980 record highs of $48.70 per ounce.

Economy Still Running Hot — But Risks Rising

On the surface, U.S. growth remains strong. But some warn the Fed’s high-rate stance could choke momentum.

Treasury counselor Joseph LaVorgna cautioned that rates risk becoming a headwind:

“The U.S. economy does need some help on the interest rate side … 3%-plus growth is great right now, but we’re not going to sustain that.”

WSA Take

Markets are in a delicate balancing act: strong economic growth on one side, policy and political uncertainty on the other. The Fed’s path hinges on data — but a shutdown may leave investors without key signals like payrolls and inflation.

Meanwhile, the commodities rally underscores a broader truth: investors are hedging against instability with hard assets. Gold and silver are flashing a vote of caution even as equities grind higher.

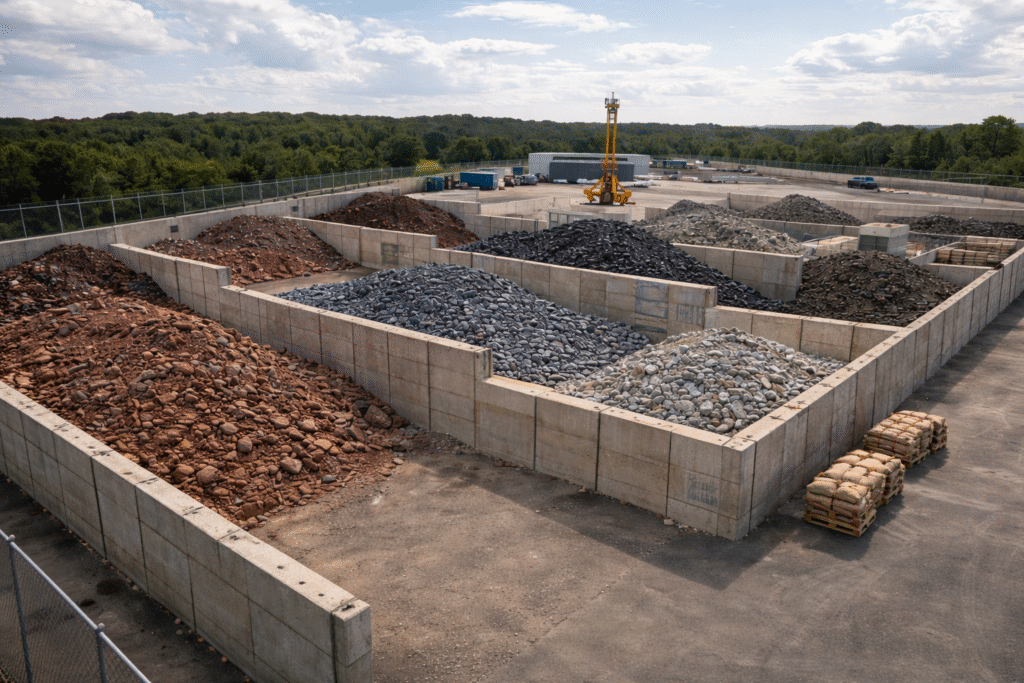

If you missed our breakdown of Anthropic’s Claude Sonnet 4.5 launch, it’s another sign of how AI innovation — and the infrastructure to support it — continues to reshape investment priorities. For more, visit the Wall Street Access homepage.

Disclaimer

Wall Street Access does not work with or receive compensation from any public companies mentioned. Content is for educational and entertainment purposes only.