Tesla is placing a long-term bet on Europe — even as its short-term performance in the region comes under pressure.

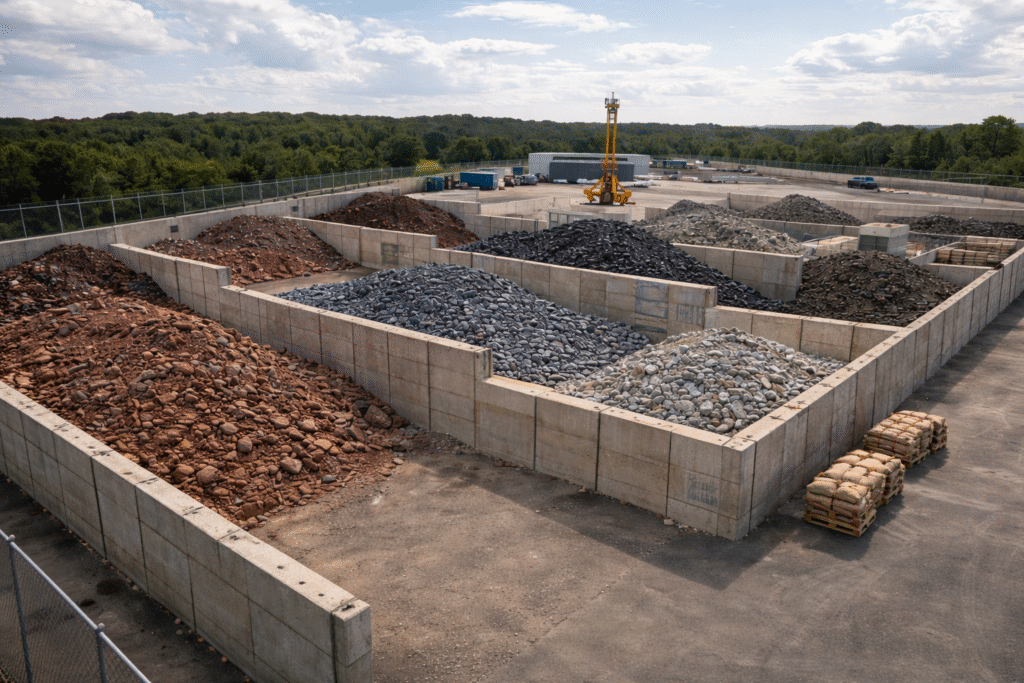

The company announced it is investing an additional three-digit million euro amount into battery cell production at its Gruenheide Gigafactory, near Berlin. The expansion is designed to enable up to 8 gigawatt hours of battery cell output per year beginning in 2027.

Once complete, total investment in on-site battery cell production will be close to €1 billion ($1.2 billion).

Why the Investment Matters

Tesla says the goal is to significantly expand vertical integration at its only European factory.

That means:

- Producing battery cells and vehicles at the same site

- Reducing dependence on external suppliers

- Improving supply-chain resilience amid global battery competition

Tesla described the setup as unique in Europe, while also acknowledging the economic challenge of producing battery cells locally.

In its statement, the company noted that, compared with China and the United States, Europe remains a difficult place to manufacture cells competitively due to costs, scale, and incentives. Still, Tesla said that if conditions allow, the full battery value chain could eventually be localized in Gruenheide.

The German facility employs roughly 11,500 workers and remains central to Tesla’s European strategy — even as that strategy faces mounting market pressure.

Sales Slump in a Growing Market

While Tesla is investing heavily in future capacity, its current sales momentum in Germany is weakening.

According to Germany’s KBA vehicle registry:

- Tesla registered 1,763 vehicles in November, down 20% year over year

- January–November registrations are down 48.4% from the same period last year

What makes the decline more striking is the broader market backdrop.

In November alone:

- German EV registrations jumped nearly 60%

- More than 55,000 electric vehicles were sold nationwide

Tesla is losing share in a market that is expanding rapidly.

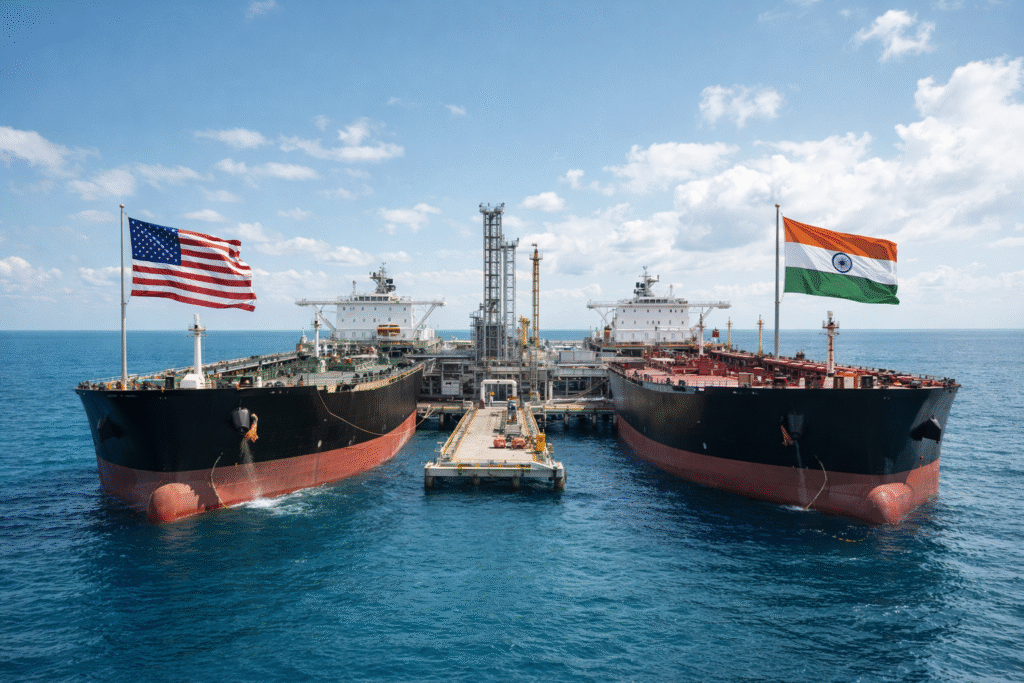

BYD Steps In

Chinese automaker BYD continues to capitalize on that growth.

In November:

- BYD registered over 4,000 vehicles in Germany

- That figure was more than nine times higher than a year earlier

- Year-to-date registrations now exceed 19,000 vehicles

BYD’s strength reflects a broader shift in the European EV market, where price sensitivity and competitive offerings are increasingly shaping consumer decisions.

Even updated versions of Tesla’s Model Y were not enough to counter rising competition or shifting incentive structures across Europe.

WSA Take

Tesla’s European story is becoming a tale of two timelines. The company is investing aggressively to secure battery control and manufacturing scale for the next decade. But in the present, competitors like BYD are exploiting pricing gaps and capturing growth in a market that Tesla once dominated. Whether Tesla’s manufacturing bets translate into renewed momentum will be one of the key EV questions in Europe over the next few years.

Read our recent coverage on Why Quantum Computing Is Moving.

Explore more market insights on the WallStreetAccess homepage.

Disclaimer

WallStAccess does not work with or receive compensation from any companies mentioned. This content is for informational and educational purposes only and should not be considered financial advice. Always conduct independent research before investing.