Why the Bond Market Still Matters

The uneasy ceasefire between Washington and the $30 trillion U.S. Treasury market is holding — but investors say it remains fragile.

After a sharp bond selloff earlier this year tied to aggressive trade policy headlines, the administration has worked carefully to avoid another revolt from bond investors. That effort has paid off for now, with yields drifting lower and volatility easing. But beneath the surface, concerns around persistent deficits and rising debt levels haven’t gone away.

A reminder of that fragility came in early November when the Treasury floated the idea of issuing more long-term debt. On the same day, the Supreme Court began reviewing the legality of sweeping trade tariffs — a potential threat to future government revenue.

The result: 10-year Treasury yields jumped more than 6 basis points, one of the largest daily moves in months.

Investors Are Watching the Term Premium

Even with calmer headline markets, one key signal has started flashing again: the term premium — the extra yield investors demand to hold long-term Treasuries — has been creeping higher.

That suggests investors still want compensation for uncertainty around:

- Federal deficits

- Long-term inflation risks

- Debt supply dynamics

As one asset manager put it, bond markets still have an unmatched ability to “terrify governments” when confidence wavers.

Treasury’s Strategy: Keep Yields Contained

Treasury Secretary Scott Bessent, a former hedge fund manager, has been explicit about his focus on yields — particularly the benchmark 10-year Treasury, which influences everything from mortgage rates to federal borrowing costs.

Key steps that have helped stabilize the market include:

- Expanded Treasury buybacks, especially for long-dated bonds

- Greater reliance on short-term Treasury bills instead of long-term issuance

- Direct consultation with major bond investors on policy and leadership decisions

- Messaging that prioritizes market stability and predictable issuance

These moves helped unwind bearish bets against long-term bonds over the summer, though some short positions have begun creeping back recently.

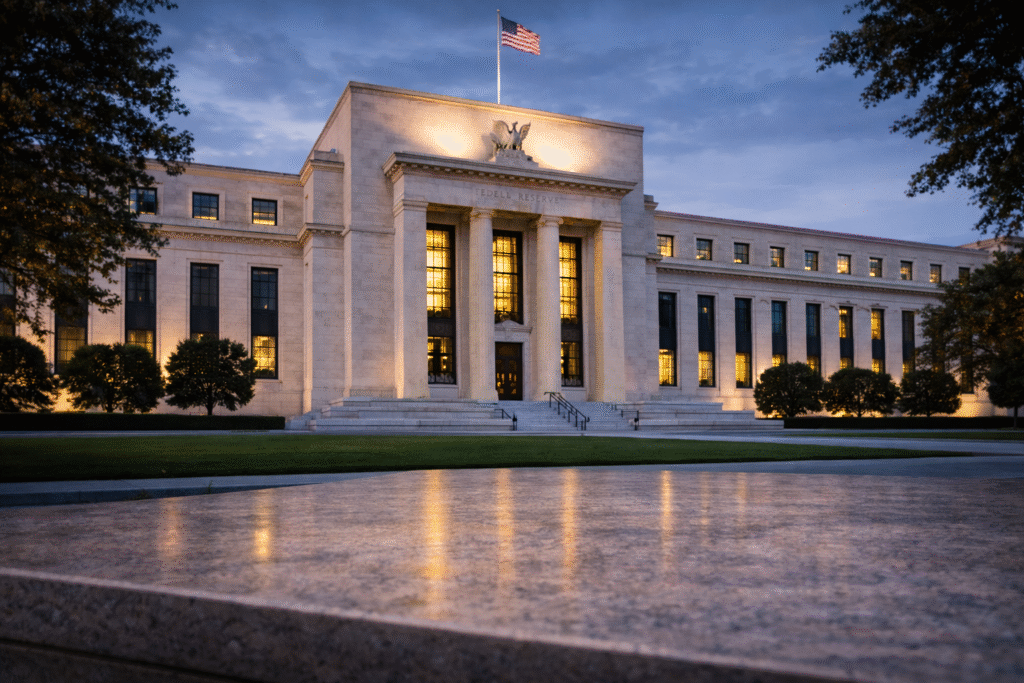

The Role of the Federal Reserve

The Federal Reserve has also played a stabilizing role. With the Fed shifting toward easing as job growth cools, Treasuries have regained some appeal as a hedge.

At the same time, the Fed’s decision to slow its balance-sheet runoff has reduced supply pressure — particularly for short-dated debt — helping absorb issuance tied to ongoing deficits.

New Buyers Are Emerging — With Caveats

Another notable development has been rising demand from stablecoin issuers, which hold large amounts of Treasury bills to back digital dollars.

Treasury officials estimate the stablecoin market could expand dramatically over the coming years, potentially creating a new structural source of demand for short-term government debt.

Still, investors caution that:

- Stablecoin demand is cyclical and sentiment-driven

- Heavy reliance on short-term debt increases refinancing risk if rates spike

What Could Break the Truce?

Market participants agree the current balance is holding — but barely.

Potential triggers for renewed bond market stress include:

- A resurgence in inflation

- Tariff-driven price pressures

- A sharp reversal in equity markets, especially AI-linked stocks

- A shift toward a more hawkish Federal Reserve stance

As one strategist put it, the bond vigilantes never disappear — they simply wait.

WSA Take

For now, Washington has succeeded in calming the bond market through careful issuance strategy, Fed coordination, and investor signaling. But the underlying math hasn’t changed.

With deficits still running near 6% of GDP and total debt hovering well above 120% of economic output, the margin for policy missteps remains thin.

The bond market may be quiet — but it’s watching closely.

Read our recent coverage on GM Stock Surging and Outperforming Tesla.

Explore more market insights on the WallStreetAccess homepage.

Disclaimer

WallStAccess does not work with or receive compensation from any companies mentioned. This content is for informational and educational purposes only and should not be considered financial advice. Always conduct independent research before investing.